Qualified Property For Ubia . ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. qualified property is defined in the statute as tangible property subject to depreciation under sec. Include the following schedules (their specific instructions are. the ubia provision becomes complex when compounded with different types of property transactions. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year and used at any point during the tax year in the production of qbi, for which the depreciable period has not ended before the close of the. qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. this article examines the calculation of the ubia of qualified property;

from www.chegg.com

ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. this article examines the calculation of the ubia of qualified property; 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year and used at any point during the tax year in the production of qbi, for which the depreciable period has not ended before the close of the. qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. the ubia provision becomes complex when compounded with different types of property transactions. Include the following schedules (their specific instructions are. qualified property is defined in the statute as tangible property subject to depreciation under sec.

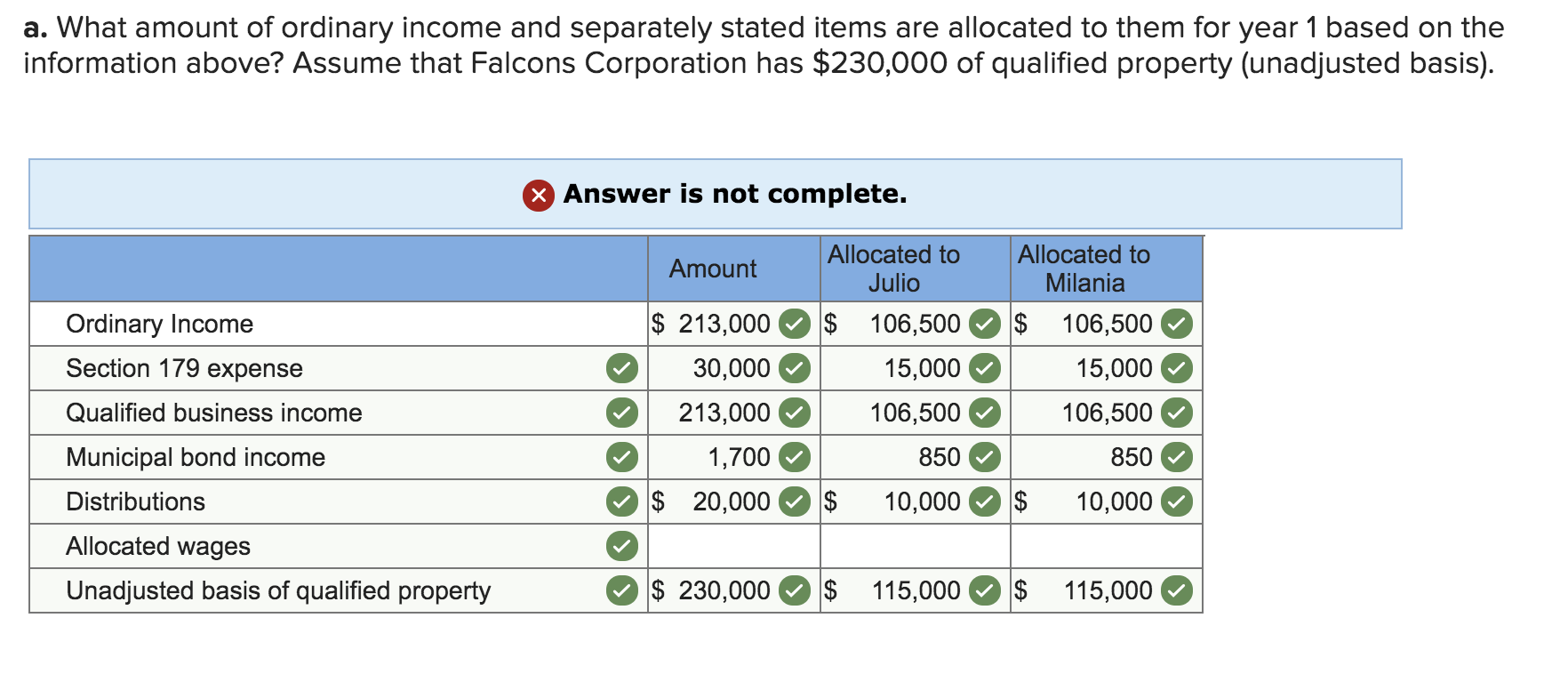

Solved ! Required information [The following information

Qualified Property For Ubia this article examines the calculation of the ubia of qualified property; ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. this article examines the calculation of the ubia of qualified property; 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year and used at any point during the tax year in the production of qbi, for which the depreciable period has not ended before the close of the. the ubia provision becomes complex when compounded with different types of property transactions. qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. qualified property is defined in the statute as tangible property subject to depreciation under sec. Include the following schedules (their specific instructions are.

From www.chegg.com

Note This problem is for the 2021 tax year. John Qualified Property For Ubia ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. qualified property is defined in the statute as tangible property subject to depreciation under sec. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. 167 that is held by, and available for use in, the qualified trade. Qualified Property For Ubia.

From www.chegg.com

Solved bona infombon from Form 11205 Continuation State Qualified Property For Ubia ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. qualified property is defined in the statute as tangible property subject to depreciation under sec. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. the ubia provision becomes complex when compounded with different types of property. Qualified Property For Ubia.

From taxanalysis.com

Using Form 8995 to Identify Your Borrower's K1s? Think Again! Bukers Qualified Property For Ubia ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year and used at any point during the. Qualified Property For Ubia.

From www.chegg.com

Solved Show that the following series diverges. Which Qualified Property For Ubia the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. the ubia provision becomes complex when compounded. Qualified Property For Ubia.

From slideplayer.com

V VH and SK. ppt download Qualified Property For Ubia the ubia provision becomes complex when compounded with different types of property transactions. ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. qualified property includes tangible property subject to depreciation under section 167 that is held,. Qualified Property For Ubia.

From www.chegg.com

Solved Note This problem is for the 2020 tax year. John Qualified Property For Ubia the ubia provision becomes complex when compounded with different types of property transactions. 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year and used at any point during the tax year in the production of qbi, for which the depreciable period has not ended before the. Qualified Property For Ubia.

From complete-conveyancing.com

What do surveyors look for during a house survey? Complete Qualified Property For Ubia the ubia provision becomes complex when compounded with different types of property transactions. this article examines the calculation of the ubia of qualified property; qualified property is defined in the statute as tangible property subject to depreciation under sec. ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. . Qualified Property For Ubia.

From slideplayer.com

Think Tax Reform Won’t Impact your Business? Think Again! ppt download Qualified Property For Ubia the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. Include the following schedules (their specific instructions are. this article examines the calculation of the ubia of qualified property; qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. qualified property is defined. Qualified Property For Ubia.

From www.pipa.asn.au

Qualified Property Investment Adviser (QPIA®) / Property Investment Qualified Property For Ubia qualified property is defined in the statute as tangible property subject to depreciation under sec. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. Include the following schedules (their specific instructions are. 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year. Qualified Property For Ubia.

From www.financestrategists.com

Qualified Personal Residence Trusts (QPRTs) Qualified Property For Ubia Include the following schedules (their specific instructions are. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. the ubia provision becomes complex when compounded with different types of property transactions. qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. 167 that is. Qualified Property For Ubia.

From slideplayer.com

IRC 199A Overview Qualified Business Deduction ppt download Qualified Property For Ubia ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. the ubia provision becomes complex when compounded with different types of property transactions. qualified property is defined in the statute. Qualified Property For Ubia.

From fabalabse.com

Is a new furnace taxdeductible in 2023? Leia aqui Can you claim a new Qualified Property For Ubia the ubia provision becomes complex when compounded with different types of property transactions. qualified property is defined in the statute as tangible property subject to depreciation under sec. ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. qualified property includes tangible property subject to depreciation under section 167 that. Qualified Property For Ubia.

From slideplayer.com

IRC 199A Overview Qualified Business Deduction ppt download Qualified Property For Ubia qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. the ubia provision becomes complex when compounded with different types of property transactions. the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. ubia means “unadjusted basis in qualified property immediately after acquisition.”. Qualified Property For Ubia.

From slideplayer.com

QBI nonSSTB Chapter 1 pp ppt download Qualified Property For Ubia qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. qualified property is defined in the statute as tangible property subject to depreciation under sec. 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year and. Qualified Property For Ubia.

From www.realtorsa.co.za

Why Engaging a Qualified Property Practitioner is Essential Under the Qualified Property For Ubia qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. this article examines the calculation of the ubia of qualified property; the ubia provision becomes complex when compounded with different. Qualified Property For Ubia.

From proconnect.intuit.com

How to enter and calculate the qualified business deduction Qualified Property For Ubia this article examines the calculation of the ubia of qualified property; Include the following schedules (their specific instructions are. 167 that is held by, and available for use in, the qualified trade or business at the close of the tax year and used at any point during the tax year in the production of qbi, for which the depreciable. Qualified Property For Ubia.

From www.wilsonrogers.net

What is the 20 QBI Deduction? Wilson Rogers & Company Qualified Property For Ubia qualified property includes tangible property subject to depreciation under section 167 that is held, and used in the production of. ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. qualified property is defined in the statute as tangible property subject to depreciation under sec. the unadjusted basis immediately after. Qualified Property For Ubia.

From www.chegg.com

Solved ! Required information [The following information Qualified Property For Ubia the unadjusted basis immediately after acquisition (ubia) of qualified property amount transfers from. ubia means “unadjusted basis in qualified property immediately after acquisition.” it is the unadjusted basis of. this article examines the calculation of the ubia of qualified property; the ubia provision becomes complex when compounded with different types of property transactions. Include the following. Qualified Property For Ubia.